Are you a value investor searching for undervalued gems in the stock market? Look no further. Our list of the top 10 value stocks is tailor-made for you. These stocks can deliver solid returns due to their attractive valuations and strong fundamentals.

Investing in value stocks is like finding hidden treasures the market has yet to recognize fully. So, if you're seeking long-term growth and financial security, join us as we uncover the diamonds in the rough and show you how value investing can pave your path to financial success.

Why Investing in Value Stocks Will Be a Win for You?

Are you ready to unlock the secrets of successful investing? Look no further than value stocks, the hidden gems of the market. In a world driven by hype and volatility, value investing offers a strategic approach that can lead to long-term financial success.

These stocks are often overlooked or undervalued by the market, presenting a unique opportunity for astute investors. Investing in value stocks can capitalize on the inherent discrepancies between a company's intrinsic value and its current market price. Let's explore why investing in value stocks will be a win for you.

Upside Potential

Value stocks are priced below their intrinsic value, offering significant upside potential. As the market recognizes their worth, these stocks can deliver substantial returns.

Safety and Stability

Value stocks are often associated with established companies with a track record of stable earnings and solid fundamentals. This stability cushions against market volatility, reducing the risk of significant losses.

Dividend Income

Many value stocks pay regular dividends, providing a steady income stream for investors. This is particularly attractive for income-focused investors looking for a reliable source of cash flow.

Margin of Safety

Do you know that value investing emphasizes the concept of a "margin of safety?" By buying stocks at a discount to their intrinsic value, you create a buffer against unforeseen risks or market downturns, increasing the likelihood of preserving your capital.

Contrarian Approach

Another benefit is that it requires a contrarian mindset, allowing you to go against the herd mentality. Investing in undervalued stocks that others may overlook will enable you to exploit market inefficiencies and potentially generate superior returns.

Long-Term Focus

Value investing is a long-term strategy that emphasizes patience and discipline. By investing in companies with solid fundamentals and growth prospects, you can benefit from their long-term success and compound your wealth over time.

Opportunity for Reversion to Mean

Over time, undervalued stocks tend to revert to their fair value as market conditions improve or investor sentiment changes. This reversion to the mean can lead to significant price appreciation, offering lucrative opportunities for value investors.

Diversification Benefits

Including value stocks in your portfolio can provide diversification benefits, reducing the overall risk. Combining value stocks with other investment strategies can create a well-rounded portfolio that balances risk and return.

Peace of Mind

Last but not least, investing in value stocks provides peace of mind, knowing that you are investing in companies with solid fundamentals and attractive valuations. This approach reduces the stress and anxiety often associated with short-term market fluctuations.

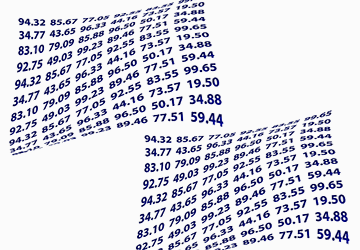

Top 10 Value Stocks for Value Investors in the Current Market

Here's the list of 10 value stocks investors should watch closely in the current market. These stocks have strong fundamentals, attractive valuations, and potential for long-term growth. Let's dive into the exciting world of value investing and discover the opportunities that await!

1.Warner Bros. Discovery (WBD)

With its vast library of valuable intellectual properties and strong content distribution channels, Warner Bros. Discovery offers significant potential for long-term growth. Investing in this media conglomerate can provide exposure to the booming entertainment industry.

2.Western Digital Corp. (WDC)

As a leading provider of data storage solutions, Western Digital benefits from the increasing demand for digital storage across various sectors. Its innovative technologies and strong market position make it an attractive investment choice in the data-driven world.

3.Alphabet Inc. (GOOG, GOOGL)

As the parent of Google, Alphabet holds a dominant position in the digital advertising and technology space. With its diverse portfolio of businesses and continuous innovation, investing in Alphabet offers exposure to the growth potential of the digital economy.

4.Pfizer Inc. (PFE)

With a robust pipeline of pharmaceutical products and a strong focus on research and development, Pfizer stands out as a top-value stock in the healthcare sector. Its global presence and commitment to improving healthcare make it an appealing investment option.

5.Johnson & Johnson (JNJ)

Known for its diversified healthcare products and a long history of consistent performance, Johnson & Johnson remains an attractive choice for value investors. Its strong financials, global reach, and focus on innovation position it well for long-term growth.

6.JPMorgan Chase & Co. (JPM)

As one of the largest financial institutions in the world, JPMorgan Chase offers stability and growth potential. With its extensive range of financial services and strong management team, investing in JPMorgan Chase can be a prudent choice for value investors.

7.Wells Fargo & Co. (WFC)

Wells Fargo is a prominent banking institution that presents value investors with an opportunity to benefit from the financial sector's recovery. Its various banking services and focus on customer relationships make it an attractive long-term investment.

8.Verizon Communications Inc. (VZ)

As a leading telecommunications company, Verizon offers a stable business model and steady cash flows. With the growing demand for wireless connectivity and 5G technology, investing in Verizon provides exposure to the ever-evolving telecommunications industry.

9.BP PLC (BP)

BP, a major global energy company, will benefit from the transition to reliable energy sources. As it diversifies its operations and focuses on sustainability, investing in BP allows investors to participate in the changing landscape of the energy sector.

10.LyondellBasell Industries NV (LYB)

With its strong position in the chemical industry, LyondellBasell presents an attractive investment opportunity. The company's global presence, diversified product portfolio, and focus on innovation make it a compelling choice for value investors.

Final Verdict

Investing in these value stocks offers the potential for long-term growth and stability. These companies have strong fundamentals, competitive advantages, and solid growth prospects. By carefully considering their financial performance, industry trends, and strategic positioning, investors can make informed decisions to build a resilient and profitable portfolio.